News & Report

55% of Hong Kong investors and 86% of Mainland investors are quite or very satisfied with their most recent fund purchases, according to a survey commissioned by Charles & Ronan Holdings amongst Hong Kong and Mainland retail fund investors.

The survey, conducted by Cimigo on behalf of Charles & Ronan Holdings in October 2016, aims to understand more about the perception and needs of Hong Kong and Mainland fund investors. (Note 1)

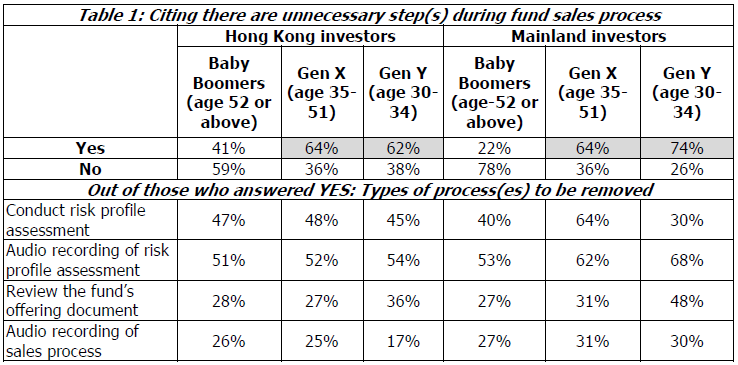

Out of the 760 Hong Kong investors who responded to the survey, 56% opine that there are unnecessary steps in the fund purchase process.

As to how to streamline the process, 52% of the aforesaid 56% (i.e. 29%) consider audio recording of the risk assessment process can do away with; while 47% (i.e. 26%) think the risk profile assessment can be removed altogether.

Similarly, 54% of Mainland investors regard that some steps can be removed, with most see audio-recording of risk profile assessment as being redundant.

Gen X and Gen Y from both markets have in particular expressed a strong desire to see the process streamlined. (Table 1)

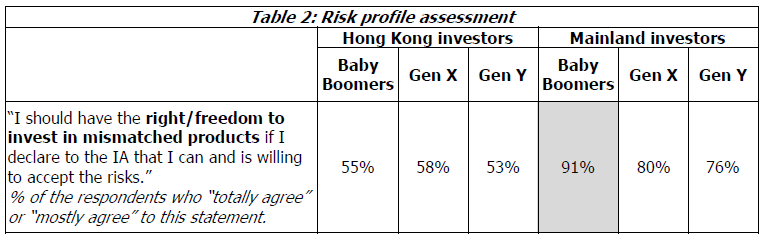

While respondents generally acknowledge the value of the risk profile assessment, 56% of Hong Kong respondents believe that they should have the right/freedom to override the result of the assessment and invest in mismatched products if they explicitly state to the Investment advisors (“IAs”) that they can and are willing to accept the risks.

Mainland investors are more ready to invest in mis-matched products, with 82% saying they should have such a right. Baby boomers in particular hold such a view. (Table 2)

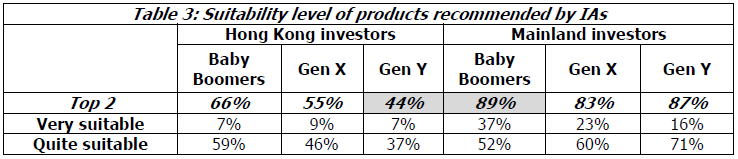

Close to 90% of Mainland investors believe that the products recommended by the IAs are very or quite suitable for them. Amongst the different cohorts, Baby boomers seem to be the most satisfied.

In contrast, only 59% of Hong Kong investors think the products are suitable, and the gap is more acute for Gen Y. (Table 3)

As to how investors define “suitability”, respondents from both markets generally see it in terms of investment outcome rather than risks.

The top three criteria being cited for finding a product suitable are “the product provided the expected level of income for me” (47%), “I received dividend income” (47%) and “the product fits my return requirement” (42%).

In contrast, very few respondents assess suitability in terms of risks - only 19% consider it in terms of whether the products fit their risk appetite, and 15% take investment duration into account.

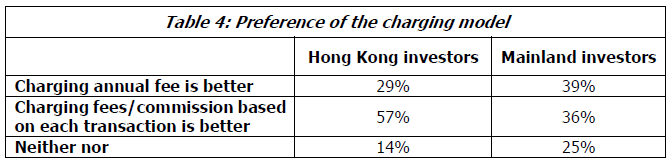

More Hong Kong fund investors prefer a commission-based model over a fee-based one, with 57% indicating so. Mainland investors’ views are mixed, with a slightly higher percentage opting for a fee-based model. (Table 4)

Those who prefer a commission-based model opine that it is fairer and easier to understand. They also think that a fee-based model is not optimal as they don’t make fund transactions frequently.

On the contrary, respondents who make frequent transactions prefer the annual fee model. Supporters also expect a wider choice of products will be made available under this model and there would be less conflict of interests.